According to CoinShares’ weekly fund flows report, crypto investment products attracted over $2 billion in inflows during the initial week of June.

Thus far in June, crypto investment products have seen inflows totaling $2 billion, bringing the cumulative figure for the past five weeks to $4.3 billion. Leading the inflows were products based on Bitcoin and Ether, buoyed by the SEC’s recent approval of spot Ether ETFs. Meanwhile, meme coins exhibited varied performances; Iggy Azalea’s MOTHER token surged following a recent announcement, whereas others like PEPE and BONK experienced declines.

In addition, the Ethereum layer-2 network Base achieved a total value locked (TVL) of $8 billion, despite facing challenges such as increased scams and controversies involving the meme coin Normie.

June Sees $2B in Crypto Inflows

June started off strong for digital asset investment products, with significant inflows across nearly all providers. According to CoinShares’ weekly fund flows report on June 10, crypto investment products attracted over $2 billion in inflows, bringing the total for the first five weeks of June to $4.3 billion.

In addition, trading volumes for exchange-traded products (ETPs) surged to $12.8 billion during the initial week of June, marking a 55% increase compared to the previous week. CoinShares noted that almost all providers of crypto ETPs experienced inflows, which is unusual and may be attributed to reactions to weaker macroeconomic indicators. The asset manager also suggested that this uptick in sentiment could be driven by expectations of an earlier monetary policy rate cut in the U.S.

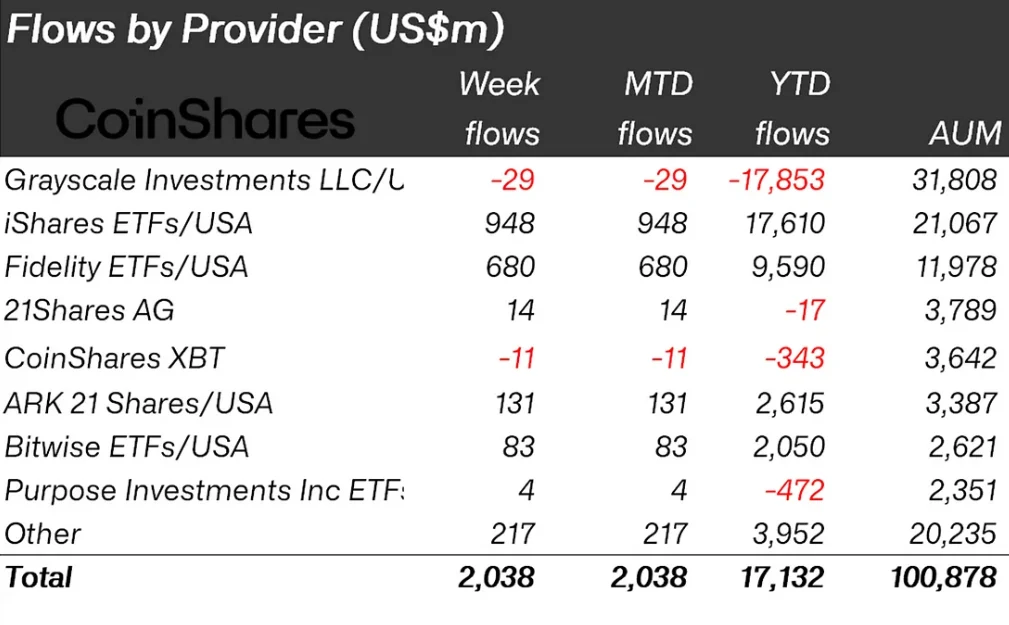

Positive market movements pushed total assets under management (AUM) above $100 billion for the first time since March 2024. Among digital asset investment product providers, Grayscale Investments and CoinShares XBT were the only ones to experience outflows for the week. The iShares exchange-traded fund (ETF) in the United States led in inflows with $948 million, followed by Fidelity ETFs at $680 million.

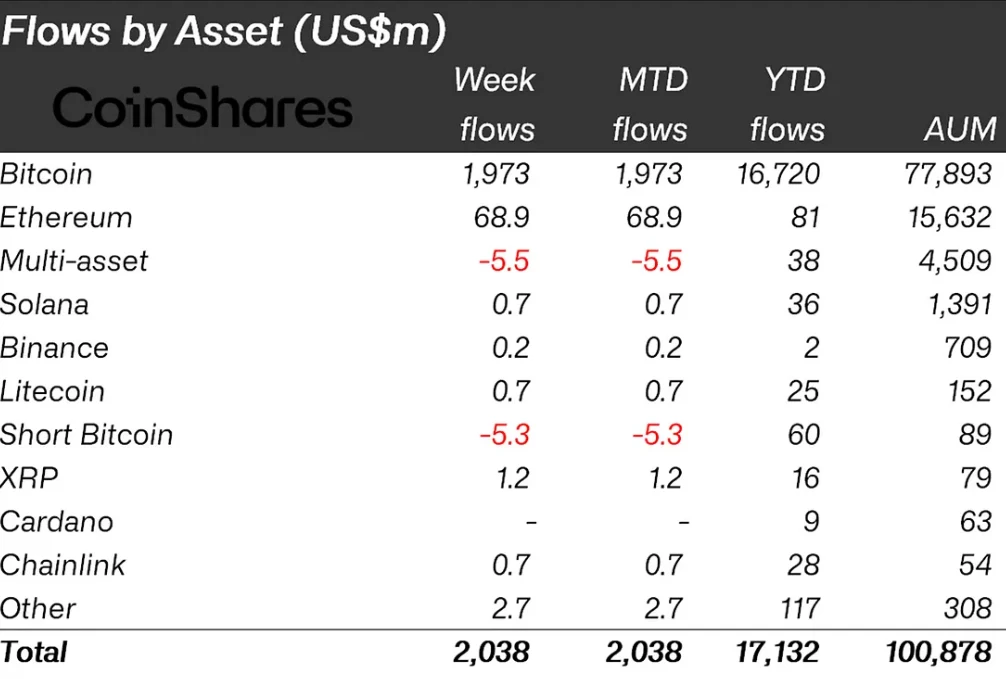

Bitcoin remained dominant in the ETF space, attracting $1.97 billion in inflows for the week. Ether-based products also saw record-breaking inflows, with CoinShares reporting a total of $69 million, marking their best week since March.

The surge in inflows is likely attributed to the Securities and Exchange Commission (SEC) approving spot Ether ETFs on May 23. Altcoin-based exchange-traded products (ETPs) also saw positive activity, with XRP recording inflows of $1.2 million.

MOTHER’s Surge

In early June, Iggy Azalea’s MOTHER token experienced a significant surge in price following an unexpected announcement. Azalea disclosed plans to relaunch her former telecommunications company, offering mobile phones and monthly cellphone plans purchasable with MOTHER or SOL tokens. This announcement drove the price of MOTHER up by over 30%, reaching $0.1958 according to CoinMarketCap. Subsequently, the token’s price has declined to $0.1644.

Tomorrow I’m finally relaunching the telecommunication company I co-founded and you will be able to purchase phones, or month to month cell plans using $MOTHER or Sol 🥳

— IGGY AZALEA (@IGGYAZALEA) June 9, 2024

Ad campaign n rollout to follow late this week. Exciting 🙊

Azalea also mentioned that the advertising campaign for the relaunch of the mobile company will commence this week, potentially further boosting social media buzz and upward momentum for the MOTHER memecoin.

While MOTHER has seen recent success, several other meme tokens have experienced significant declines over the past week. PEPE’s price dropped by over 19% to $0.00001163, while BONK and WIF fell by 18.9% and 22%, respectively.

Unlike major cryptocurrencies, meme coins typically lack intrinsic utility or underlying value. Their market dynamics heavily rely on social media hype, leading to considerable price volatility.

Most celebrity-launched meme coins have struggled recently, with Caitlyn Jenner’s JENNER token plummeting more than 63% since its debut.

Base Hits $8B TVL

Base, the Ethereum layer-2 network, has achieved significant milestones recently. Its total value locked (TVL) surpassed $8 billion shortly after surpassing Optimism’s OP Mainnet.

As of June 10, according to L2Beat data, Base’s TVL reached $8.05 billion, although it has since slightly decreased to $7.87 billion. Supported by Coinbase, Base is now the largest chain in the Superchain ecosystem and ranks second in Ethereum scalability by TVL, trailing Arbitrum One’s $18.27 billion.

Base achieved a $1 billion TVL milestone on February 27, just seven months after its August 2023 launch, and has experienced substantial growth in the past 104 days. It leads all Ethereum layer-2 networks in transactions per second over the last month at 30.36, surpassing Arbitrum One’s 23.52. Base processed 64.86 million transactions during this period.

Additionally, Base has shown impressive on-chain profits, hitting a record $16.9 million in March, according to Dune Analytics. Despite a 58.6% decline to $6.98 million in May, Base still outperformed OP Mainnet, which recorded $1.57 million in profits last month. Much of these profits were driven by the early 2024 meme coin frenzy.

We've recently witnessed one of the craziest meme season on Solana.

— Xremlin (@0x_gremlin) March 21, 2024

Those who were early and savvy enough have earned thousands or even millions of dollars.

Now, the attention slowly shifts to Base memes, and we can potentially see a crazy run there too. pic.twitter.com/QabqsLX4r4

However, Base’s popularity among meme coins has also attracted scammers, resulting in an alarming 18-fold increase in funds stolen from phishing scams between January and March.

Normie Fires Intern

Base, the blockchain hosting the meme coin project Normie, has garnered attention for less favorable reasons. Normie announced the dismissal of an intern after an offensive video was posted on its official X account.

After careful consideration and internal reflection, we have decided to remove our last video.

— Normie (@NormieBase) June 10, 2024

The intended message was to demonstrate that there is always a way out, even when everything is coming at you, and that positive change begins with oneself. It was never our intention…

Normie’s team acknowledged removing the controversial video and issued apologies for any offense caused. The video, posted on June 10, depicted a blue-skinned cartoon chef with exaggerated features, prompting criticism within the crypto community. Some questioned whether solely blaming the intern was fair, suggesting it reflected a failure in oversight.

Normie clarified that the video aimed to convey overcoming challenges and promoting positive change, rather than trivializing sensitive issues.

In recent months, Normie faced setbacks, including a smart contract exploit resulting in hackers stealing 225 Ether ($881,686). This incident led to a significant drop in the token’s market cap by $41.7 million in just three hours. Normie later agreed to the hacker’s terms to return 90% of the stolen tokens in exchange for launching a new token from the recovered funds and its development wallet.

As of June 7, Normie reported recovering 192 ETH and successfully launching the new token at a different address. Since April 1, a total of 372,642 new tokens have been launched on the Ethereum network, with 88% of them hosted on Coinbase’s layer-2 blockchain, Base.