This article will explore the wide and varied world of blockchain technology. We’ll look at the more than 1,000 blockchains that exist as of 2024, each with unique uses for different industries.

Overview of Blockchain Technology

Blockchain technology represents a fundamental shift in how we manage and distribute data, best known for supporting cryptocurrencies. A blockchain is a decentralized digital ledger that records transactions across multiple computers, ensuring data security and integrity. Its main purpose is to offer a tamper-proof and transparent system for exchanging information without needing a central authority. This technology is ideal for applications where trust, accountability, and unchangeable records are essential.

How Many Blockchains Are There?

There are numerous blockchain networks in existence, with prominent examples including Bitcoin, Ethereum, and Solana. Additionally, the blockchain space continues to expand as many organizations and projects create their own chains to meet specific needs.

So, how many blockchains are there?

The exact number is hard to determine due to the constantly evolving nature of the Web3 space. However, estimates suggest that there are at least 1,000 existing blockchains!

What Are the Different Types of Blockchains?

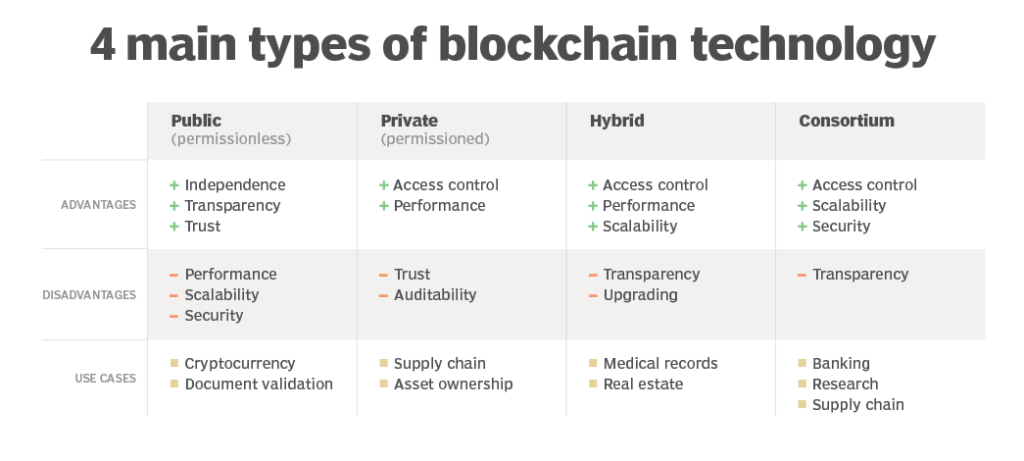

There are four main types of blockchain networks: public blockchains, private blockchains, hybrid blockchains, and consortium blockchains. Each type offers distinct advantages, disadvantages, and ideal applications. Let’s briefly explore each one:

- Public Blockchains: These are permissionless and fully decentralized networks open to anyone. Public blockchains are commonly used for activities such as cryptocurrency exchanges and mining (e.g., Bitcoin, Ethereum).

- Private Blockchains: These are permissioned networks where participation is restricted to a select group. Typically managed by an organization or company, private blockchains control who has read and write access (e.g., Hyperledger Fabric).

- Hybrid Blockchains: Combining elements of both public and private blockchains, hybrid blockchains are managed by a single entity that determines access to specific data and decides which information is made public.

- Consortium Blockchains: Similar to hybrid blockchains but managed by a group rather than a single entity, consortium blockchains facilitate collaborative efforts among a predefined group of participants. Access is generally restricted to members of the consortium (e.g., R3 Corda.

Historical Growth

Since the introduction of the original blockchain underpinning Bitcoin, the blockchain space has experienced remarkable growth. The number of distinct blockchains has surged from just a handful to over 1,000 by 2024. This historical trajectory demonstrates a pattern of consistent year-over-year growth, driven by increasing adoption in various fields beyond cryptocurrency, such as finance, supply chain management, and digital identity verification.

What Purpose Do the Different Types of Blockchains Serve?

The various types of blockchains each have unique advantages and disadvantages, serving distinct purposes based on their characteristics. In this section, we’ll take a closer look at the purposes of public blockchains, private blockchains, hybrid blockchains, and consortium blockchains.

Public Blockchains

Public blockchain networks offer numerous benefits, making them well-suited for certain applications. Some key advantages include:

- Transparency: Every transaction is visible to all participants, ensuring complete transparency.

- Decentralization: There is no central authority; control is distributed across the network, enhancing security and resilience.

- Pseudonymity: Participants can engage in transactions without revealing their identities, protecting privacy.

- Open Access: Anyone can join and participate in the network, promoting inclusivity and innovation.

These advantages make public blockchains ideal for use cases such as:

- Cryptocurrency Exchanges: Facilitating the trade of digital currencies like Bitcoin and Ethereum.

- Transparent Organizations: Supporting entities that prioritize transparency and trust, such as decentralized autonomous organizations (DAOs).

Private Blockchains

Private blockchain networks offer significant benefits in terms of privacy, security, speed, and scalability. These advantages make them well-suited for specific applications where control and confidentiality are paramount. Key benefits include:

- Privacy: Access is restricted to authorized participants, ensuring sensitive information remains confidential.

- Security: High security through cryptographic techniques and controlled access, reducing the risk of unauthorized activities.

- Speed: Faster transaction processing due to a smaller number of participants and controlled environment.

- Scalability: Improved scalability as the network can be optimized for the needs of the controlling entity.

These benefits make private blockchains ideal for use cases such as:

- Supply Chain Management: Tracking the movement of goods and verifying the authenticity of products within a closed network.

- Asset Ownership: Managing and verifying ownership of assets in a secure and private manner.

- Internal Voting: Conducting secure and confidential voting processes within organizations or groups where privacy is crucial.

Hybrid Blockchains

Hybrid blockchains offer a blend of features from both public and private blockchains, providing a balanced approach to flexibility, privacy, and scalability. Key advantages include:

- Closed Ecosystems: Ability to create controlled environments with selective data sharing.

- High Flexibility: Customizable to meet specific needs, allowing for various configurations of public and private elements.

- Privacy with Communication: Ensures privacy while enabling secure communication and data exchange within the network.

- Better Scalability: Enhanced scalability by optimizing both public and private aspects.

These characteristics make hybrid blockchains ideal for use cases where selective data sharing is necessary. For instance:

- Medical Records: Storing medical records on a hybrid blockchain allows patients to access their own data via smart contracts while keeping sensitive information private and secure.

- Financial Services: Managing transactions and customer data, where certain information needs to be public (e.g., transaction history) while sensitive details remain private.

- Government Services: Offering public access to certain government records while maintaining confidentiality for sensitive data.

Consortium Blockchains

Consortium blockchains, governed by a group of organizations, provide a balanced approach to security, control, and efficiency. Key benefits include:

- High Security: Shared control and validation among trusted entities enhance security.

- Enhanced Control: Collaborative governance allows for better management and oversight.

- No Transaction Fees: Potential elimination of transaction fees due to the cooperative nature of the network.

These advantages make consortium blockchains ideal for various collaborative and high-security use cases. For instance:

- Banking: Multiple banks forming a consortium to streamline payment processes, increasing efficiency and reducing costs.

- Payments: Secure and efficient processing of payments between participating organizations.

- Supply Chain Management: Tracking and verifying the movement of goods among multiple partners, enhancing transparency and efficiency across the supply chain.

Different Types of Blockchain Examples

Now that we have an overview of the various types of blockchains, let’s explore some examples for each type. We’ll start with public blockchain networks.

Public Blockchain Examples

- Bitcoin: The original and most well-known cryptocurrency, Bitcoin operates on a fully decentralized public blockchain.

- Ethereum: A leading platform for decentralized applications (dApps) and smart contracts, Ethereum’s public blockchain is widely used for various innovative projects.

- Litecoin: Often referred to as the silver to Bitcoin’s gold, Litecoin is another public blockchain focused on fast and low-cost transactions.

Private Blockchain Examples

- Hyperledger Fabric: A permissioned blockchain framework designed for enterprise use, offering privacy and scalability for business applications.

- Corda: Developed by R3, Corda is a private blockchain platform tailored for financial institutions to manage and track agreements securely.

- Quorum: An enterprise-focused version of Ethereum, Quorum is designed to handle private transactions within a permissioned environment.

Hybrid Blockchain Examples

- Dragonchain: Originally developed by Disney, Dragonchain offers a hybrid blockchain platform that combines public and private blockchain features for secure and scalable business solutions.

- XinFin (XDC Network): XinFin’s hybrid blockchain is designed for international trade and finance, enabling private transactions with selective data transparency.

- Ripple: While often considered a public blockchain, Ripple can operate in a hybrid manner, enabling private transactions between financial institutions with public oversight of the overall network.

Consortium Blockchain Examples

- R3 Corda: While it can be used as a private blockchain, Corda also supports consortium networks where multiple organizations collaborate.

- B3i (Blockchain Insurance Industry Initiative): A consortium blockchain created by major insurance companies to streamline industry processes and increase efficiency.

- We.Trade: A blockchain-based trade finance platform developed by a consortium of major banks to simplify and secure international trade transactions.

Major Blockchain Platforms

Within the universe of blockchain technology, certain platforms have risen to prominence due to their unique features, widespread use, and active development communities. Here are two of the most significant ones:

Bitcoin Blockchain

The Bitcoin blockchain is the progenitor of all modern blockchains, having introduced the concept of a decentralized digital currency in 2009. It operates on a proof-of-work (PoW) consensus mechanism and maintains a high level of security through its extensive node network. Bitcoin’s main function is to serve as a peer-to-peer payment system. Key features include:

- Decentralization: No central authority; transactions are validated by a network of nodes.

- Security: High security through cryptographic techniques and extensive node participation.

- Proof-of-Work: A consensus mechanism that involves miners solving complex mathematical problems to validate transactions and secure the network.

Ethereum

Ethereum expanded the functionality of blockchain with the introduction of smart contracts—self-executing contracts with the terms written directly into code. Launched in 2015, Ethereum’s blockchain is a platform for building decentralized applications (dApps). It is transitioning to a proof-of-stake (PoS) consensus model to improve scalability and energy efficiency. Key features include:

- Smart Contracts: Automated, self-executing contracts that facilitate, verify, or enforce the negotiation or performance of an agreement.

- Decentralized Applications (dApps): Applications that run on a decentralized network rather than a single server.

- Proof-of-Stake Transition: Moving from PoW to PoS to enhance scalability, reduce energy consumption, and increase transaction speeds. The new PoS model involves validators who are chosen to create new blocks based on the number of coins they hold and are willing to “stake” as collateral.

These platforms have set the foundation for numerous other blockchain innovations and continue to be at the forefront of blockchain development and adoption.

Other Prominent Blockchains

Beyond Bitcoin and Ethereum, several other blockchain platforms have risen to prominence, each catering to specific needs and use cases with innovative approaches to consensus models, transaction speeds, and overall philosophy.

Tron

- Focus: Decentralized internet and entertainment.

- Features: Designed to enable content creators to interact directly with consumers, removing intermediaries. It supports a high throughput and scalability.

- Use Cases: Content distribution, gaming, and social media.

Ripple (XRP Ledger)

- Focus: Fast, cross-border payments.

- Features: Tailored for financial institutions, Ripple offers quick and cost-effective international payments with minimal fees and real-time gross settlement.

- Use Cases: International remittances, cross-border transactions, and banking.

Stellar

- Focus: Connecting financial institutions for large transactions.

- Features: Aims to make financial systems more interoperable and efficient, facilitating large-scale transactions between institutions with low fees and fast processing times.

- Use Cases: Cross-border payments, remittances, and micropayments.

Solana

- Focus: High throughput and fast transaction processing.

- Features: Known for its scalability and high-speed transactions, Solana uses a unique consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS).

- Use Cases: Decentralized finance (DeFi), decentralized apps (dApps), and scalable applications.

Polkadot

- Focus: Interoperability between different blockchains.

- Features: Enables diverse blockchains to transfer messages and value in a trust-free fashion through a shared security model, supporting interoperability and scalability.

- Use Cases: Cross-chain communication, DeFi, and multi-chain ecosystems.

Each of these blockchains addresses different aspects of the digital and financial world, contributing to the overall advancement and diversification of blockchain technology. Their unique features and specific focuses help to broaden the application and impact of blockchain across various industries.

Emerging and Niche Blockchains

As the blockchain ecosystem continues to evolve, a new wave of emerging and niche blockchains is beginning to emerge. These blockchains are characterized by their specialized features and targeted applications, often designed to address the unique requirements of specific industries. Here are some examples:

Industry-Specific Blockchains

Healthcare Blockchains

- Focus: Patient data privacy and integrity.

- Features: Secure storage and sharing of medical records, patient consent management, and interoperability between healthcare providers.

- Use Cases: Electronic health records (EHRs), medical research, telemedicine, and drug traceability.

Financial Blockchains

- Focus: Transaction speed, security, and regulatory compliance.

- Features: High-speed transaction processing, smart contract functionality for automated compliance, and identity verification mechanisms.

- Use Cases: Cross-border payments, remittances, asset tokenization, and regulatory reporting.

Supply Chain Blockchains

- Focus: Provenance and authenticity assurance.

- Features: Tracking and tracing capabilities for goods and products, transparent supply chain management, and smart contracts for automated logistics.

- Use Cases: Food traceability, counterfeit prevention, product recalls, and ethical sourcing verification.

Other Emerging and Niche Blockchains

Environmental Blockchains

- Focus: Carbon footprint tracking and environmental impact assessment.

- Features: Decentralized carbon offset marketplaces, transparent emissions reporting, and incentivization mechanisms for sustainable practices.

- Use Cases: Carbon credits trading, renewable energy certification, and sustainability reporting.

Identity Blockchains

- Focus: Digital identity management and authentication.

- Features: Self-sovereign identity solutions, biometric authentication, and verifiable credentials.

- Use Cases: Secure access to services, KYC (Know Your Customer) processes, and identity verification for voting and government services.

Art and Collectibles Blockchains

- Focus: Authenticity and provenance for digital art and collectibles.

- Features: Non-fungible tokens (NFTs) for unique digital assets, decentralized marketplaces for art trading, and provenance tracking.

- Use Cases: Digital art ownership, collectibles trading, and intellectual property rights management.

These emerging and niche blockchains demonstrate the versatility and adaptability of blockchain technology, offering tailored solutions to address specific challenges and opportunities across various industries and domains.

Innovative Use Cases

The landscape of niche blockchains is rich with innovative applications that harness the potential of blockchain technology beyond conventional use cases. Here are some examples:

Decentralized Identity Systems

Decentralized identity systems empower users with control over their digital identities. They feature self-sovereign identity solutions, decentralized authentication mechanisms, and verifiable credentials. Use cases include secure access to services, KYC processes, and identity verification for voting and government services.

Energy Trading Blockchains

Energy trading blockchains facilitate transparent peer-to-peer energy transactions without intermediaries. They feature decentralized energy marketplaces, smart contracts for automated trading, and tokenization of energy assets. Use cases include renewable energy trading, incentivizing energy conservation, and grid management.

Supply Chain Transparency

Supply chain transparency solutions enhance transparency and traceability across supply chains. They feature immutable records of product provenance, smart contracts for automated compliance, and real-time monitoring of goods. Use cases include food traceability, ethical sourcing verification, and counterfeit prevention.

Intellectual Property Management

Intellectual property management blockchains protect and monetize intellectual property rights. They feature non-fungible tokens (NFTs) for digital assets, smart contracts for licensing agreements, and transparent ownership records. Use cases include digital art ownership, music royalties distribution, and tokenization of creative works.

Data Monetization Platforms

Data monetization platforms enable individuals to monetize their data securely and transparently. They feature data tokenization, decentralized marketplaces for data exchange, and privacy-preserving technologies. Use cases include personal data marketplaces, healthcare data sharing, and targeted advertising.

Challenges and Considerations

As the number of blockchains proliferates, several key challenges emerge that impact their practicality and efficiency. These challenges primarily revolve around scalability and interoperability, which are critical factors for widespread blockchain adoption. Key considerations include:

- Scalability: Ensuring that blockchain networks can handle increasing transaction volumes without sacrificing speed or efficiency.

- Interoperability: Facilitating seamless communication and data exchange between different blockchain networks to enable cross-platform compatibility.

- Security: Mitigating the risk of security breaches, hacks, and vulnerabilities in blockchain protocols and smart contracts.

- Regulatory Compliance: Navigating the complex regulatory landscape to ensure compliance with applicable laws and regulations.

- User Experience: Improving the usability and accessibility of blockchain applications to encourage adoption among mainstream users.

Addressing these challenges will be crucial for realizing the full potential of blockchain technology and unlocking its benefits across diverse industries and applications.

Scalability Issues:

Blockchains face scalability issues because they must process a vast number of transactions quickly and cost-effectively. Current blockchains vary in their transaction throughput, with Bitcoin handling about 7 transactions per second (tps) and Ethereum around 30 tps. In comparison, traditional payment processors like Visa can handle approximately 24,000 tps. This discrepancy can lead to:

- Delayed transactions and higher costs: The network can become congested, slowing down transaction verification and increasing fees.

- Challenges in adopting blockchain: For mainstream adoption, blockchains must scale while maintaining security and decentralization.

Interoperability Concerns:

Interoperability concerns become evident when considering the collaboration between different blockchain systems. With multiple blockchains, each functioning independently, seamless interaction is crucial to:

- Transfer data and value: Ensuring that different blockchains can communicate without intermediaries is vital for true decentralization.

- Build a broad ecosystem: Enabling different blockchains to work together can expand use cases across industries and system boundaries.

Blockchains must overcome scalability and interoperability challenges to realize their full potential and achieve broad adoption.