While “coin” and “token” are often used interchangeably, they carry distinct meanings in the world of cryptocurrency. Understanding these differences is crucial for any crypto investor. Let’s delve into how coins and tokens differ and whether one might be a more favorable investment option than the other.

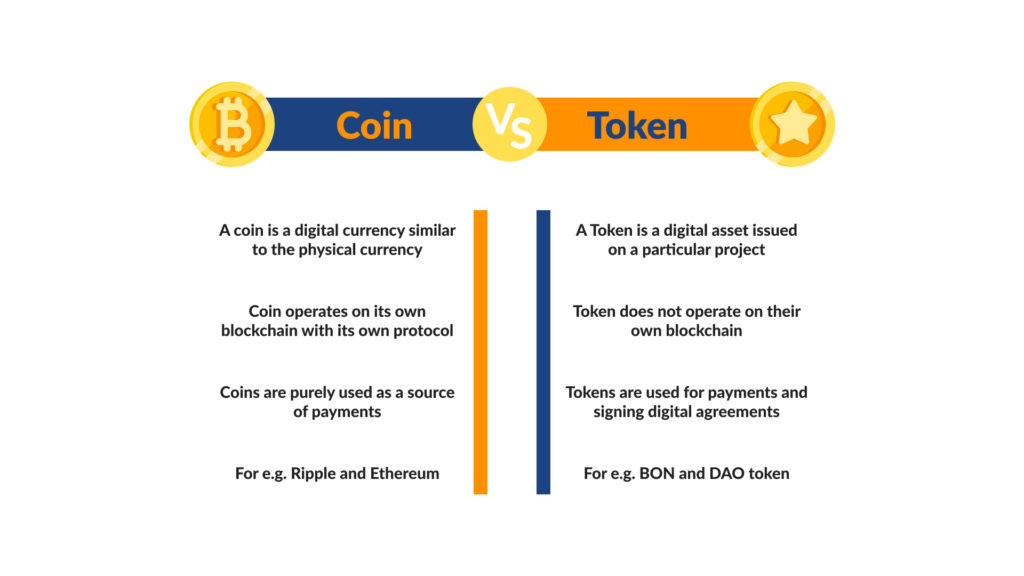

Coins are cryptocurrency assets that have their own independent blockchains and protocols. They function similarly to traditional fiat currencies and are primarily intended for use as payment methods or stores of value.

When people think of “cryptocurrency,” they’re often referring to coins, which are digital currencies in their own right. Some of the most well-known coins include Bitcoin, Ethereum, and Ripple.

What Is a Crypto Token?

Crypto tokens differ from coins in that they do not have their own blockchains; instead, they operate on existing cryptocurrency networks. They are often created by various organizations and projects using the infrastructure of other blockchains.

While tokens may share similarities with the native coin of the blockchain they run on, they serve a different purpose. Unlike coins, which are primarily used as stores of value or payment methods, tokens represent a distinct asset type.

Ethereum is one of the most popular blockchains for token creation, hosting the widely used ERC-20 token standard. Tokens are enabled by smart contracts and typically exhibit four defining characteristics:

- Transparent: All transaction data and rules governing the token are visible and verifiable by anyone. This transparency ensures accountability and trust within the token ecosystem.

- Programmable: Tokens are developed and deployed using smart contract technology, enabling developers to define and program the token’s features, functions, purpose, and rules. This programmability allows for customization and automation of token operations.

- Trustless: Tokens operate in a decentralized manner, meaning they do not rely on a central authority for governance. Instead, they are governed by the rules defined in their protocol through smart contracts. This eliminates the need for trust in intermediaries and fosters a trustless environment where transactions are executed based on predefined protocols.

- Permissionless: Tokens are accessible to everyone without requiring specific credentials or permissions. Anyone can participate in token transactions, hold tokens, or interact with token-based applications, promoting inclusivity and openness within the token ecosystem.

What Do Tokens Actually Do?

So, what’s the deal with tokens? Well, they’re like coins you can invest in for a chance at making some cash. But here’s the kicker: tokens actually have a job to do! They’re not just for trading.

Tokens can represent real things like physical stuff or special services. For example, they might get you access to exclusive merchandise or cool features in apps or games on the blockchain.

And get this, some tokens even let you have a say in how things run! You can vote on stuff like changes to the system or new ideas people want to try out. It’s like having a say in the neighborhood block party!

Types of Crypto Tokens

Tokens can be divided into several different sub-groups depending on their design and purpose. Let’s take a look at the most common ones.

Non-Fungible Tokens (NFTs)

NFTs, short for non-fungible tokens, are quite famous these days. They don’t have any practical use; instead, they’re more like fancy collectibles. Each NFT represents something unique, like a digital artwork, video, or even a tweet.

Think of NFTs as digital certificates of ownership. They’re created using smart contracts, just like other tokens, and they’re used to claim ownership of special digital stuff.

Utility Tokens

Utility tokens are pretty neat. They give you access to stuff like goods and services within a certain platform or digital product. Sometimes they let you use the platform, get discounts on fees, or even access it for free.

These tokens are super important for decentralized apps (dApps) and other DeFi projects. Plus, owning them can give you all sorts of perks beyond just making money.

And here’s the kicker: utility tokens usually aren’t regulated, so they’re not seen as investment products. They’re more like keys to unlock cool stuff online.

Security Tokens

Security tokens are a bit different. They’re tied to real-world assets like bonds, stocks, or property, and can be traded just like securities. But here’s the twist: they’re digital!

Because they represent real assets, security tokens are often regulated by financial authorities. They might represent ownership in something, like a stake in a company or property. And guess what? Holders might get special perks, like a share of profits or a say in decision-making.

These tokens offer some cool benefits, like transparency and instant settlement, thanks to blockchain tech. And there are two main types: equity tokens and asset-backed tokens. They’re like the fancy cousins of traditional securities, with a digital twist.

Governance Tokens

Governance tokens are pretty straightforward. They give you a say in how things run in a project or platform.

With these tokens, holders get to vote on stuff like upgrades or changes. Sometimes it’s all automated through smart contracts, and other times the project team handles it manually.

The cool thing about governance tokens is they give power to the people. By letting holders have a say, projects become less centralized and more community-driven. It’s like democracy in the crypto world!

Examples of Crypto Tokens

There are tons of different tokens in the crypto world. For NFTs, you’ve got big names like the Bored Ape Yacht Club or even the first-ever tweet.

When it comes to governance tokens, a standout example is Maker (MKR).

Most tokens still hang out on the Ethereum blockchain, but other networks are gaining traction, like Tron and Solana. This shift’s partly because Ethereum’s gas fees are getting pretty high.

Oh, and some cryptos have different versions of their tokens on different blockchains. Take USDT, for instance.

The Difference Between a Coin and a Token

The main difference between coins and tokens boils down to their technical structure. Coins have their own blockchain, while tokens don’t. Tokens usually serve a specific purpose, so their value isn’t solely based on supply and demand or market speculation.

Tokens are way easier to create compared to coins since you don’t have to build a whole new blockchain for them. That’s why there are way more tokens floating around than coins.

Knowing the difference between coins and tokens is handy for understanding the crypto you’re dealing with. But if you’re ever unsure, a quick online search can clear things up.

FAQ

Which is better – coins or tokens?

Coins and tokens serve different purposes, so one isn’t necessarily better than the other.

Is Bitcoin a coin or a token?

Bitcoin has its own blockchain, so it’s a coin.

Can a token become a coin?

Yep, tokens can evolve into coins if they create their own successful blockchain and move over to it. Examples include Binance Coin (BNB) and Tron (TRX).

Does every blockchain need a token?

Nope, tokens aren’t mandatory for blockchains.

Disclaimer: The information in this article is solely the author's opinion and should not be construed as financial or investment advice. We do not guarantee the completeness, reliability, or accuracy of the information provided. The cryptocurrency market is highly volatile, and prices can fluctuate unpredictably. Before making any investment decisions, it's essential to conduct thorough research and consider multiple viewpoints. Additionally, it's crucial to be aware of and comply with all local regulations governing cryptocurrency investments.